Business Design Challenge

2018 Rotman Design Challenge Top 5 Finalist

Challenge

How can CIBC become a leader in financial planning for our clients by scaling beyond traditional channels, over the next 10 years?

Team

Jee Eun Lee, Hernán Maestre, Eliška Skarolková, Niduan Zhou, Varun Prabhu

Project duration

4 weeks

Contribution

Design research / Storyboarding / Ideating / Idea Pitching

User testing / Data collection / Idea Visualization

Roman Design Challenge is a business design challenge for worldwide master-level students of any field. This challenge aims for blending business design with design methodologies and business acumen to create a process that helps identify broader opportunities, create new ideas and accelerate market success. In 2018, CIBC was a client who asked us to come up with new channels for the upcoming 10 years to lead a banking industry.

Opportunity Space

With the increase of mobile-only banking, users missed that familiar face they could trust and ask for advice while banking.

“Going to the bank is time-consuming as it’s not close to my location.”

“Mobile bank is a cold-faceless interaction.”

“I miss that familiar face that helps me with my problems.”

“I hate the robot that answers when you call the bank. It’s impersonal.”

“I hate having to explain to every banker my needs everytime I go.”

-User’s voices from primary research

Scoping Possible Solutions

Proposed Solution

Goal

To enable CIBC customers become more financially literate and confident through new means of customer acquisition and growth.

Concept

Banking services that meet you where you are, in location, and in life, providing customized face-to-face banking services.

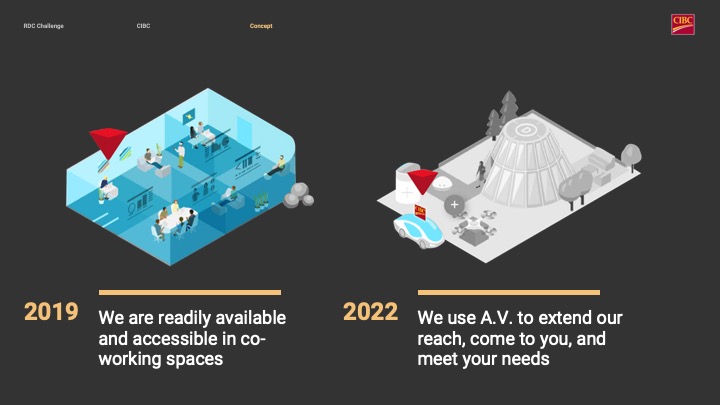

Proposed New Channels

Co-working spaces and mobile offices

Solution Storyboard

Martin is a remote worker, and he works in a co-working space.

He has many aspirations. He wants to build his own business. He concerned about saving for his kids’ future. And he wants to buy his first home. But he doesn’t know how to manage his finances, and doesn’t know how to get help.

But he sees a CIBC office that has a REACH advisor, in his co-working space. He realizes that the banker who sits there, Alice, is available to talk with members of the space.

One day, Martin asks if she can help him. She tells him she absolutely can.

Alice and Martin arrange to meet later in the week. He brings his financial information with him, and they talk about his goals. Alice, with his agreement, inputs his financial information into the CIBC system and visually details his customized financial strategy using the bank’s personal financial planning tools. Martine really trust Alice, and he decides to shift his accounts to CIBC so that he can continue working with her.

He is able to track progress towards his financial goals through the CIBC system, but also knows he can contact Alice anytime. That makes him feel more confident.

Before too long, Martin is able to launch his own business.

But now he has financial goals, questions and concerns related to his business.

He wishes he understood his business finances as well as his personal finances.

But he remembers that Alice said he could call her for advice. So he calls her, and explains the challenges his facing.

Alice says she can personally introduce him to a REACH advisor who specializes in small business finance. She calls Peter, and tells him about Martin. Martin and Peter set up a time to meet in person - Peter tells Martin he will meet him where he is.

At the date and time agreed, Peter travels in a mobile office to meet Martin.

Because the mobile office is self-driving, Peter has time to do some preparatory work as he travels to Martin.

He loads Martin’s business accounts through the CIBC system, and connects them to CIBC’s small business financial planning tools. He draws some initial insights about the financial position of Martin’s business.

He pulls up, and the digital panel welcome Martin to the REACH Mobile Office.

Peter asks Martin what his specific goals are, and then uses CIBC small business planning tools to help create a financial strategy for the business. Martin is grateful to have another banker he can connect with, and knows he’ll see Peter again.

Iteration Process

First Storyboard and collected feedback from users

Iterated storyboard and final user testing

Concept testing video